Roof Storm Damage in MA: Is Wind and Hail Damage Covered?

Roof Damage from Massachusetts Storms and the Immediate Steps You Should Take

When a storm hits, your roof may suffer damage from heavy rain, strong winds, or debris. Acting quickly can prevent further issues. Here’s how to assess, document, and repair storm damage while avoiding scams and navigating insurance claims effectively.

- Ensure safety first: Check for hazards like loose power lines or structural damage.

- Inspect and document: Look for missing shingles, dents, or leaks; photograph all damage.

- Contact professionals: Hire a licensed, insured roofing contractor for a thorough assessment.

- File insurance claims promptly: Provide detailed documentation to your insurer.

- Beware of scams: Avoid contractors demanding full payment upfront or pressuring quick decisions.

Is Hail and Wind Damage Covered in Massachusetts?

Yes, hail and wind damage are typically covered under homeowners insurance policies in Massachusetts, but coverage details depend on the specific policy.

Does Standard Homeowners Insurance Coverage Policy Cover Hail & Wind Damage?

Yes, most homeowners insurance in Massachusetts covers wind and hail damage to your roof. But it depends on your policy details.

Wind Damage: Covered for storms, even hurricanes, unless your policy says otherwise.

Hail Damage: Covered if hail breaks or dents your roof badly enough for repairs or replacement.

Are there Additional Deductibles for Wind & Hail?

Some policies have a special deductible for wind or hail that is higher than your usual one.

In coastal areas, insurers may require a hurricane or windstorm deductible (often a percentage of the home’s insured value rather than a flat amount).

Are there any Exclusions and Limitations?

Roof Age & Condition: If the roof is old or poorly maintained, the insurer may deny the claim or offer only partial reimbursement based on depreciation.

Cosmetic Damage: Some policies may exclude minor hail damage that doesn't affect the roof’s function.

Named Storms: If a storm is classified as a hurricane or named storm, a separate deductible might apply.

Can I buy Additional Coverage for Hail and Wind?

Yes, you can buy extra insurance if your policy doesn’t cover enough, especially for older roofs or high-risk areas. Ask your insurance agent.

Sources on Hail and Wind Roof Insurance in MA

The DOI, part of the Office of Consumer and Business Regulation, oversees the state’s insurance industry and provides consumer-focused resources. Homeowners can visit this website for guides on homeowners insurance, including what standard policies cover for damage like hail and wind.

The Mass.gov website has easy guides about homeowners insurance. They say most policies cover wind and hail damage to your roof unless it’s left out. But flood damage isn’t included—people sometimes mix it up with rain from wind—and you’d need a separate policy for that. It’s a good place to start learning what your roof insurance covers.

What does Storm Damage Look like?

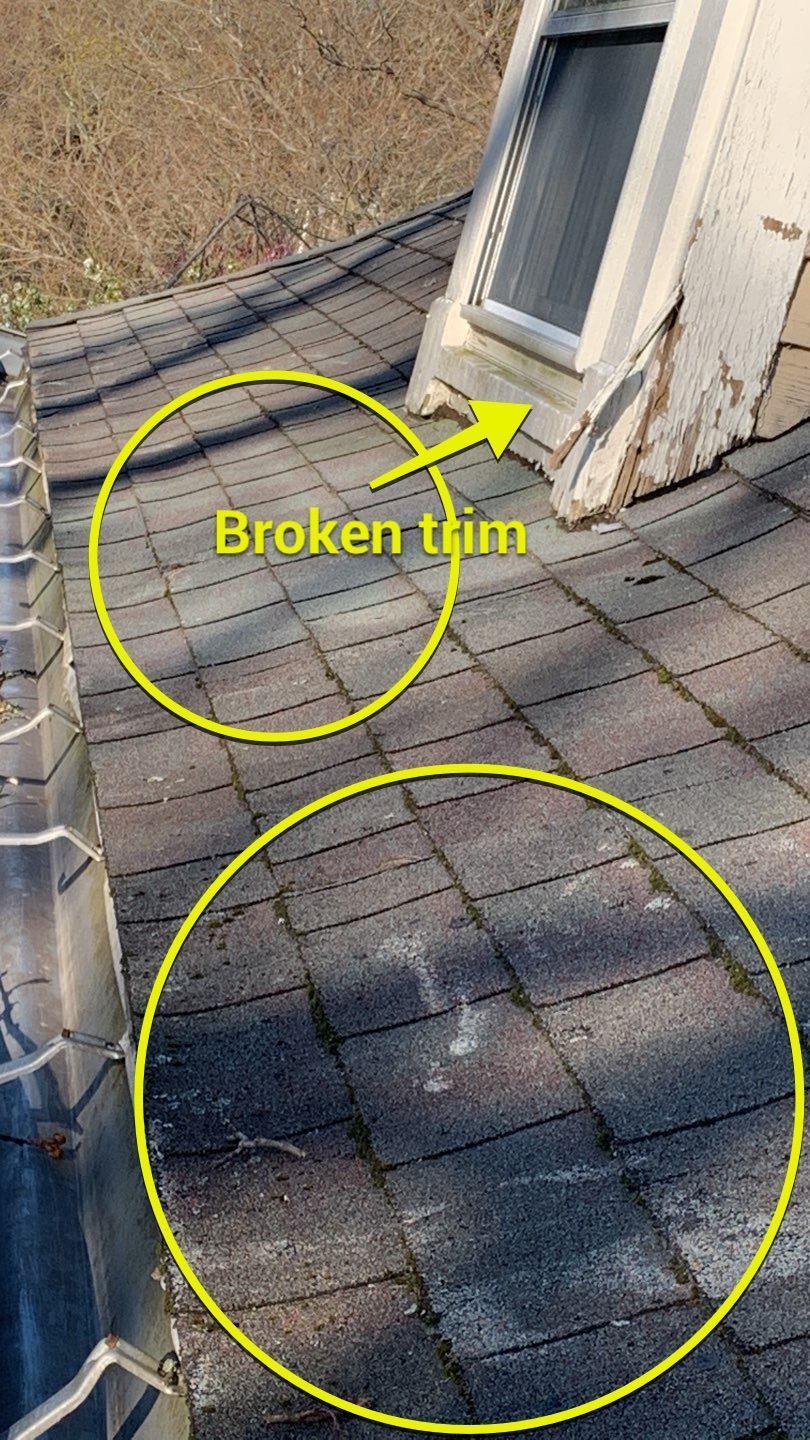

Master Roof has extensive experience addressing homes in Massachusetts affected by hail and wind storms. Below are several images showcasing damage to shingles, gutters, and trim.

Steps You Should Take After Storm Damage

Figuring out the process for repairing a damaged roof can be overwhelming. In this article, our team from Master Roof provides you with a step-by-step guide on what to do if a storm damages your roof.

1. Safety First

First things first, always ensure the safety of yourself and your family. If there are any visible hazards, such as loose power lines or unstable structures, keep a safe distance and contact emergency services if necessary. If there's significant structural damage, consider temporary relocation or at least avoid compromised areas. Look for the following signs of damage to your roof:

- Missing, curled, or broken shingles

- Dents or cracks from hail or debris

- Exposed underlayment or roof decking

- Clogged or damaged gutters and downspouts

- Water leaks or stains inside your home

If you see signs of major damage, such as a partial roof collapse or large holes, take immediate action to prevent further damage. Call an emergency roofing service right away.

2. Check the Damage

As soon as it’s safe to do so, carefully inspect your roof from the ground. Look for signs of visible damage, such as missing or damaged shingles or other roofing materials, dents, or fallen branches. If available, use binoculars to get a closer look and as soon as possible, contact Master Roof or another contractor for a professional inspection of the entire roof.

If there's immediate danger (like a hole in the roof), you might need to cover it with a tarp or other temporary fix. Some insurance policies allow for emergency repairs before the adjuster arrives but check with your insurer first.

If you can safely reach the damaged area, cover it with a tarp or plywood to prevent water from entering your home. This temporary fix will help prevent additional costly damage until permanent repairs can be made.

3. Document the Damage

Take photos and videos of the damage both inside and outside your home. Carefully examine the house for water spots and any signs of damage. Capture close-up shots of damaged shingles, flashing, and any leaks or water stains inside. If possible, timestamp the images. This documentation will be crucial when filing an insurance claim and ensuring you receive the proper compensation for repairs.

- Snap photos and videos of damage inside and outside—close-ups of shingles, leaks, or dents.

- Timestamp them if you can.

- This proof helps when you file an insurance claim.

4. Hire a Trusted Roofer like Master Roof for Storm Damage Inspection

When it comes to dealing with storm damage to your roof, selecting a reliable roofing company is crucial. A trustworthy roofing contractor not only ensures that your roof is repaired or replaced correctly but also plays a pivotal role in navigating the complex process of insurance claims. It's essential to verify that the company is fully licensed and insured, which protects you from liability issues should anything go wrong during the repair or replacement process. Moreover, an experienced roofing company, adept at handling insurance claims, will advocate fiercely on your behalf.

Choose a company like Master Roof that uses technology to stay ahead of severe weather events like hailstorms and high winds. The Roof Hub Weather Coming and GAF Weather Hub tools used by Master Roof benefits their clients by:

- Providing instant notifications about incoming hail and wind storms, allowing roofers to prepare in advance.

- Notifiers roofers and customers before storms hit, improving safety and readiness.

- Using these tool to prioritize neighborhoods for inspections right after a storm.

- Faster response times mean roofers can be among the first to offer repairs and insurance claim assistance.

- Having historical storm data helps roofers provide evidence of hail or wind damage when working with homeowners and insurance adjusters.

- Supports accurate documentation, reducing disputes and increasing claim approvals.

5. Watch Out for Storm Chasers and Fraudulent Contractors

After major storms, out-of-town contractors known as “storm chasers” may offer quick, cheap repairs. These companies often do cheap work and leave town before any issues arise.

- Choosing a local company like Master Roof with good reviews.

- Checking their license and insurance.

- Saying no to upfront full payment or pushy deals.

6. File a Claim with Your Insurance Company

It’s essential to notify your homeowner’s insurance company promptly. They will guide you through the claims process and provide you with the necessary information on what’s covered by your insurance policy and what documents will be required. It is often a good idea to have a professional roofing company present when the insurance adjuster visits to advise on the extent of the damage and the cost of repairs.

Master Roof team possesses the expertise to accurately assess whether your roof requires mere repairs or a full replacement, and they understand the intricacies of claim documentation and negotiations with insurance providers. This experience also equips them to detect and deter any attempts at fraudulent claims, ensuring that the process remains fair and legitimate. Choosing such a company can save you from potential headaches, ensuring that your roof and your interests are in capable hands.

Be sure to ask about:

- Your coverage details, including deductibles and limitations.

- The claim filing process and required documentation.

- How long it will take for an adjuster to inspect your roof?

Your roofing contractor can often assist in dealing with insurance adjusters to ensure all damage is properly accounted for.

Follow These Steps for the Roof Repair Process

1. Obtain Multiple Quotes from Roofing Contractors

Getting at least three quotes for roof repair is crucial for several reasons. Firstly, prices for roofing services can vary significantly due to factors like contractor availability, material costs, and the scope of work.

By collecting multiple quotes, homeowners can ensure they are not overpaying due to an inflated estimate from a single source. This practice also allows for a comparison of services offered, helping to identify which contractor provides the best value, not just the lowest price. Moreover, multiple quotes can reveal the true condition of your roof; some contractors might suggest unnecessary replacements or repairs for profit, whereas others might offer more cost-effective solutions for the same issue.

This comparison also aids in verifying the credibility and expertise of contractors, ensuring you choose someone with a reputation for quality work.

2. Review the Contract

Once you’ve selected a roofing company, carefully review the contract. Make sure that it includes all necessary details such as materials, costs, timelines, and warranties. Feel free to ask questions if something needs to be clarified. The contract should include the following:

- The scope of work (including any emergency repairs already done).

- Materials to be used (preferably with brand names).

- Total cost, payment schedule, and any potential extra costs.

- Warranty details.

- Timeline for completion.

- Cleanup and disposal of debris.

3. Stay Informed & Updated

Throughout the repair process, stay informed about the progress. A reputable roofing company will keep you updated on the status of the work and any unexpected issues that arise.

4. Make Sure There is a Thorough Final Inspection

After completing the repairs, conduct a final inspection with the roofing company to ensure the work meets your expectations. Make sure all debris is removed from your property.

5. Register the Roof Warranty

Ensure the contractor registers any manufacturer's warranty for the materials used. Keep a copy of this registration for your records.

6.Close the Building Permit

If a permit is required for your repairs, ensure it's closed after the work is inspected and approved by local authorities. An open permit could result in a penalty or a problem later, especially if you want to sell the house.

Why Choose Master Roof?

Storms are tough, but Master Roof makes fixing your roof easier. We’re a trusted, award-winning Massachusetts company with top materials and warranties. Safety comes first, then fast action and good records.

When it comes to insurance claims for wind, hail, and storm damage, Master Roof has years of experience helping homeowners like you. We know how to spot damage that insurance adjusters might miss, like hidden hail dents or wind-torn shingle and we document it right to boost your claim’s approval odds. Our team works directly with your insurance company, handling the tricky paperwork and negotiations so you don’t have to. Whether it’s a small repair or a full roof replacement, we’ve got a proven track record of getting fair payouts for storm damage across Massachusetts.

Contact us today to help your family with roof repair and we’ll get your home back to normal quicky!